Global share markets opened the new year on a massive sugar high, supported by unprecedented expansionist monetary policy, commonly referred to as QE Infinity. Central Bank balance sheets have exploded to unparalleled and anomalous levels, never seen before. The virus has thrown Europe and many parts of the USA into various stages of lock-downs, for much of 2020 and the start of 2021. The vaccine has begun to roll-out in the West, with high hopes of a return to social and economic normality. The success and effectiveness of the vaccine will be measured by the extent of the return to any social normalcy and economic renaissance. The problems remain, with the percentage of the uptake and also the mutations of the virus, possibly rendering the whole process moot?

Monetary expansionism has been complimented by a fiscal boom in investment from the Government, funded by deficit and debt. The welfare/bail-out support has tempered the damage and camouflaged the statistical, economic data. The real damage to the economy will not be fully appreciated until the assistance is removed. The political benefits have been immense, as Governments seen as supporting the dramatic and severe lock-downs and welfare support, have been rewarded. The NZ Labour administration is a shining example of this, as having many policy failures, were none-the-less re-elected with a historical landslide victory!

The RBNZ has followed global Central bank orthodoxy and massively expanded the money supply and virtually eliminated interest rate functionality. The purchase of Government issued bonds by the Central Bank, is known as monitising debt. This is ‘the cardinal sin of Central Banking’ but has been readily and enthusiastically employed by the RBNZ and most major Western Central Banks. This has effectively eliminated interest rates as a measure of risk, determined by market demand and supply, throwing markets into a state of flux. This distortion will result in severe foreseen and unforeseen consequences. The new monetary policy has distorted economic orthodoxy and crossed many boundaries. Will there be time to re-write economic books on the evolution of ‘nouveau monetary theory’, or will the system self-destruct first?

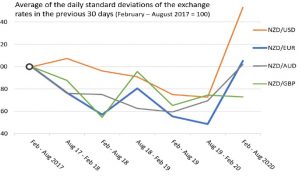

QE Infinity has funded asset bubbles in housing and many other asset classes. One of the beneficiaries has been commodities. The associated commodity currencies have also been major beneficiaries, with the AUD and NZD both reaching record highs. These trade exposed commodity economies have been sorely tested by challenges to the supply chain and massive external and internal structural disruptions. The rise in currencies is great for the importer and assists in sustaining the consumer lead economic recovery, but exporters are feeling the pain.

Europe has been suffering various stages of lock-downs, due to resurgent virus infection levels and have experienced far more severe conditions than the geographically isolated Australia and New Zealand. The roll-out of the vaccine, as the solution to this devastating pandemic, has been grossly mishandled by the EU. The economic and social devastation will be long-lasting and intergenerational. The hope of a timely solution, to these unprecedented calamities, has been squarely shouldered by the vaccine. This is no silver bullet to the crises, but EU national leaders opted to place the vaccine roll-out in the hands of the EU bureaucrats. Europe has had mixed success in the confrontation the epidemic, but the EU has shown the highest incompetency of all, vindicating the many criticisms of big Government, far removed from the people it professes to serve.

The Macro situation is the direct result of the ‘once in a century’ pandemic and the feckless Governmental solutions. On a micro-level, companies have had demand and supply distortions, labour challenges and global supply chain disruptions. These have all presented unprecedented challenges for companies and their functioning. It is all about survival and adapting and ‘controlling what can be controlled’. Foreign Currency management is one of those ‘controllables’ which can be effectively managed, to reduce risk and ensure effective FX cash flow management.

The world is emerging out of the pandemic nightmare but is not yet out of the fire-storm. The recent rise in interest rates may be a good sign for economic growth but is also a danger signal. The era of unprecedentedly low-interest rates has to lead to easier debt management, on both micro and macro levels, but the rising cost of capital will challenge inflated deficit and debt levels. This also provides investment challenges, for the future, as more options emerge.